If you read the topic "Fundamental (Micro) Balance Sheet" you should remember the part called "Equity". At last, Equity will be the section that ties Income Statement and Balance Sheet together. Profit/Loss will increase/decrease the equity which can be interpreted as a wealth of a company's stock holder.....let's see how "Income Statement" looks like!

|

| Single Step |

The example above is the Single-Step income statement which is the simplest form of income statement. Just revenue minus cost, that's all!

Next, some companies use Multi-Step income statement.

|

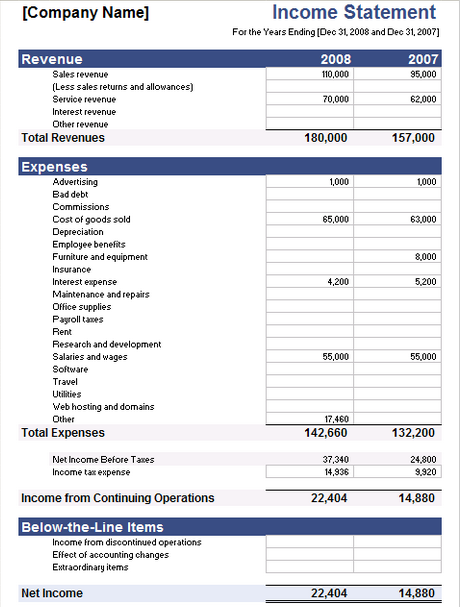

| Multi-Step |

You might get confused at this point why it is so different, but actually it is the same principle that revenue minus cost!

Everything from the beginning to the red cross (X) is the company's main operation transaction which is easy to understand. We call it "Income from continuing operations". I will explain the highlighted topics that do not appear in the single-step income statement.

1. Discontinue operations: A segment or major business line that a company plans to sell/abandon.

2. Extraordinary item: Some unusual transactions or infrequent, such as natural disaster and new law effects.

3. Cumulative effect of accounting change: Such as inventory method FIFO, LIFO.

We will stop about Income Statement here. I just want you to get some senses out of it, don't need you to be an expert! Next, we will explore some more about "Cash Flow Statement".

No comments:

Post a Comment